Financial Inclusion Solutions

- Biometric interface & e-KYC

- Corporate use case

- Wallet linking to prepaid card programme or to bank account

- Remittance from wallet / card / bank account

- Cash to cash using Aadhaar

Integrated Domestic Money Remittance Platform for Bank's

Given the various challenges in the conventional system of banking - GI offers an integrated system which is time tested, robust and contributes 80% of IMPS based domestic remittances in india using our own switching capabilities

SYSTEM SCALABILITY

- User Management and controls with all encryptions

- Access authentication as per bank's requirements

- BC partner on-boarding and approvals

- Document Management

- Revenue share management for BC Partner, BC Agent and Auto Settlement system

- Host to host connections with CBS

- BC agents on-boarding and approvals

- Sender registration process and KYC approval

- Beneficiary registration process

- Multiple remittance mode - cash to bank, card to bank and etc

- Multiple remittance channel - IMPS (IFSC), MMID, NEFT

- Auto upload of NEFT Transactions

- Auto download of response file (Option) to BC Partner System

- Refund Management OTP based

- Sender and beneficiary - common data pool for interoperability

- MIS Controls

- OTP and SMS engine

PROCESS INVOLVED

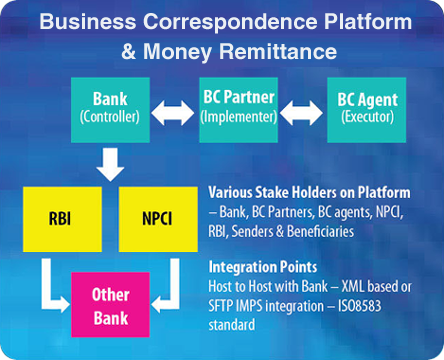

Remittance and Banking Correspondent platform

GI Integrated Remittance and Banking Correspondent platform provides a powerful suite of products and services that facilitate the bank to grow their agent led business fast. This platform enabled easy appoint of BC partners or BC / Specialized agents who can acquire customers for banks, issue mobile wallets or create accounts to new customers, facilitate domestic money remittance, issue of cards through wallet, Cash in/ Cash out, CMS, other financial and banking transactions. This platform will synchronize with the core banking systems on a regular basis or even live.

GI Integrated Remittance and Banking Correspondent is used by leading private banks like YES BANK who are market leaders in retail domestic remittance and urban financial inclusion and now 3 more customers are going to go live.

GI Remittance Engine is a core module of the GI Integrated Remittance and Banking Correspondent platform is perfect for banks and PPIs who want solutions only for their retail domestic remittance business. This remittance engine works on both IMPS and NEFT for P2A, P2P, P2M transactions with good back end controls and MIS. This is majorly used by banks and PPIs.

GI's IMPS Transaction Switch which is the core of the GI Remittance Engine is now being made available as a standalone module for banks and financial institutions that want just the IMPS switching without the Remittance Engine. GI's IMPS transaction switch can be used on a standalone basis by banks and financial institutions for transaction processing, validations, refunds and settlements.

Wallet Management

Wallet Management is a part of the GI Prepaid platform. This can be used for mobile, eCommerce and Physical card based wallets. Banks and financial institutions will find it useful for large volume B2B and B2C transactions.

Copyright © 2014 GI Technology pvt Ltd. All rights reserved.